Need Proof you are overtaxed? The state of Wyoming has over $30,000,000,000 (billion) of your tax dollars in various reserve accounts managed by the Treasurer. The government has no money. It is your money.

- Action

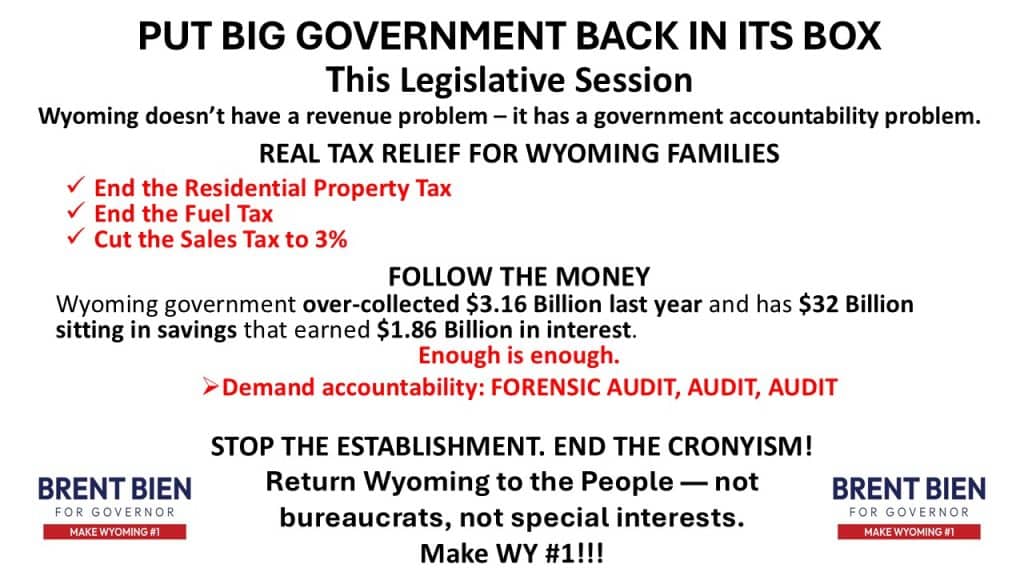

– Abolish the $650 million in Residential property taxes.

– Cut the sales tax from 4% to 3%, which is $325 Million.

– End the .24 cent per gallon fuel tax of $160 million.

– Reduce taxes by $28 million, on agriculture farms and ranches.

– Total reduction in taxes: $1.36 Billion. That still leaves over $500,000 in interest in savings reserves and is a win win for the people and the state.

- No “increase” of Automatic Distribution of tax revenue to county, districts or municipalities. This is the road to mandatory tax increases and recurring lawsuits for perceived shortages just like occurs with the Block grants to School Foundation.

– My teams certified Peoples Ballot Initiatives to exempt 50% of Assessed Value or your residence will be Placed on Ballot in November 2026. It is your backstop and firewall if the current Budget Session fails to reduce all these taxes.

Despite the false narrative that Wyoming is a “low tax state” promulgated by the governmentalists across our state, the taxpayers see it differently. People are far better stewards of their money than the government. I will leave the taxes with the taxpayer.

People’s Initiative to Limit Property Tax in Wyoming through a Homeowner’s Property Exemption

Circulation Status: Complete; Filed with the Secretary of State’s Office

Committee Member: Brent Bien

Audit. Audit. Audit.

The first thing I want as Governor, and before I approve any new appropriations, we will have a wall to wall statewide audit completed. We need an audit to improve Government efficiency, perform Gap analysis on government services, identify essential and non essentials, and eliminate frivolous spending. Wyoming government has 1 Government worker for every 3 private sector workers. 1:4. The US state average is 1:100. Property tax. It takes 80 civilian workers to pay for each government worker.

The 2023 Residential property tax collected was $639 million or 29% of the total state property taxes of $2.2 Billion). In 2024 Residential went up to $656 million. The recent 25% reduction Bill leaves $159 million in your wallet and gives the government $480 million.

You know we are paying excessive residential property taxes when there is excess of $30 Billion is in Savings and the government still spends $7 billion a year. Need I mention $100s of millions on Blue and Green Climate Initiatives and alternative Wind and Solar subsides for billionaire corporations?

The 25% property tax compromise ignored the will of the people and should have remained at 50% without any under table backfill to the counties. A compromise was already made prior to convening this legislative session by reducing the original goal of 100% down to 50%. It is not their money to negotiate with. It is the Peoples money. We routinely hear from legislatures that “it’s a good start”. What does that mean?

I want Title 39 changed to end the Department of Revenues ability to determine the value of any property. The same government that taxes you determining the value of the property they tax is a conflict of interest.

Representatives must reform Title 39 Tax statute to eliminate tax on Unrealized Capital Gain? I would like to end this madness by implementing Acquisition value. The definition is in WS 39-11-101 Fair market value” means the amount in cash, or terms reasonably equivalent to cash, a well informed buyer is justified in paying for a property and a well informed seller is justified in accepting, assuming neither party to the transaction is acting under undue compulsion, and assuming the property has been offered in the open market for a reasonable time..